Credit reporting

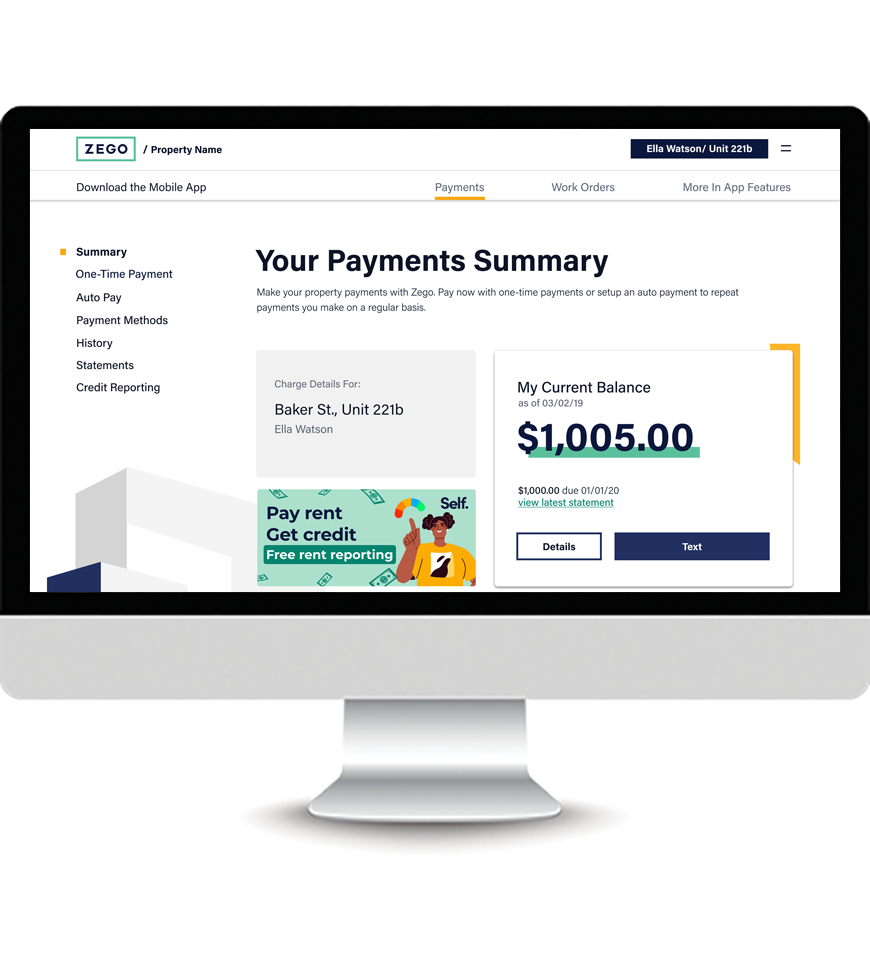

Zego has partnered with Self, a leading credit-bureau platform, to deliver credit reporting to your residents.

Zego Pay Credit Reporting

With credit reporting, you can offer residents a unique benefit when they pay rent online. Residents will enroll with Self to automatically have rent payments reported to all three major credit bureaus – Experian, TransUnion, and Equifax.

Providing credit reporting can also help you attract and retain more responsible residents. It's a win-win for all.

Start saving time & improving cash flow with rental credit reporting

Contact us to learn more about credit reporting and the benefits to you and your residents.

Why residents love building credit by paying rent

-

Easily build credit without debt:

Residents can build their credit histories by automatically reporting rent payments they make.

-

Get a leg up on future plans:

Residents can work towards improving their credit scores and reaching financial goals with greater access to lower interest rates for car and home loans.

-

Enjoy a unique (and free) community benefit:

Residents can report rent to credit bureaus at no additional cost.

Credit Reporting Lookback

Residents may choose to take advantage of the Zego™ Pay Credit Reporting Lookback feature that automatically detects previous payments made through Zego Pay for up to two years on the same lease. Reported in bulk, this allows residents to benefit from their prior payments history if desired, for a one-time fee.

Are you a resident that has questions about how rental credit reporting works? Visit our FAQ page.

How Credit Reporting works

1. Residents opt in

Residents can opt-in with Self through the Zego Pay platform at no additional cost.

2. Rent payments are reported

All rent payments made through the Zego Pay platform (ACH, credit, debit, digital wallet, CashPay) are automatically reported to all three major credit bureaus through Self.

3. Residents can build their credit

Help your residents achieve their financial goals, and attract and retain responsible residents with this valuable benefit.

4. Communities thrive

By encouraging residents to pay online and on time, you improve cash flow, reduce delinquencies, and give valuable time back to your staff!

Why property managers should offer rental credit reporting

-

Stand out amongst competitors:

Differentiate your community with rental credit reporting, which helps you attract and retain responsible residents. Research by TransUnion shows that 67% of renters would choose the apartment with rental payment credit reporting in place when selecting between identical apartments.

-

Save time:

Reduce manual paper processing when more residents pay rent online. Research by TransUnion also shows that 73% of renters would be more likely to make on-time rent payments if property managers reported rent payments to credit bureaus.

-

Improve cash flow:

Reduce delinquencies with a unique community benefit that encourages on-time rent payments online.

Chat with a Zego expert

Become another Zego success story with our resident experience management technology that frees management companies to go above and beyond for residents. See how with a customized demo.

Please note your current LevelCredit tradeline will be closed in good standing – no action is required to complete this process. If you want to continue rent reporting you will need to enroll with Self. If you have any questions about your account please contact our support team.

FAQ's about multifamily rent reporting

With Zego Pay Credit Reporting, multifamily properties can offer residents credit building benefits just by paying their rent. When residents consistently make on-time rent payments, rent reporting services send that data to the three major credit bureaus: Experian, TransUnion, and Equifax. This encourages on-time rents and reliable revenue for property managers while helping residents responsibly build credit month after month.

Residents can improve their credit score and build credit simply by paying rent on time -- something they consistently must pay each month. By reporting to credit bureaus through on-time rent payments, residents can build credit history faster and enjoy more financial opportunities from higher credit scores.

By reporting rent to credit bureaus, property managers encourage stronger financial responsibility from residents while enjoying on-time, reliable revenue, lower payment delinquency rates, and happier residents.