Chargeback Protection: How Property Managers can Fight, Win, and Prevent Credit Card Chargebacks

Learn strategies to protect against credit card chargebacks and reduce application and rent chargebacks from prospective renters and current residents.

“Put it on my card” has become a moot statement. What else would you pay with? Sure, digital wallets like Apple Pay have gained momentum. Bitcoin is going through its ups and downs. But cash? Paper checks? Forget about it.

A survey by Money magazine found that 72% of people carry less than $100 in cash on a daily basis, and only one out of every five Americans carries a checkbook anymore. The need to tote around chunky change, paper bills, or a checkbook has been almost eliminated by the credit card industry.

That’s because credit cards build credit, help users afford big-ticket purchases, and offer exciting rewards programs, including cash back, or frequent flyer miles. In fact, 45% of Millennials said that if a store didn’t accept credit cards, they would leave and shop somewhere else. Even parking meters in most urban areas accept credit cards.

In the multifamily industry, accepting credit cards from applicants and residents is nothing new. Property owners and managers want to improve resident satisfaction by offering the convenience of multiple payment options.

However, allowing credit card payments inevitably leads to rent payment collection risks, including the occurrence of application and rent payment chargebacks. And without credit card chargeback protection, those costs add up. Multifamily portfolios lose ten of thousands of dollars each year.

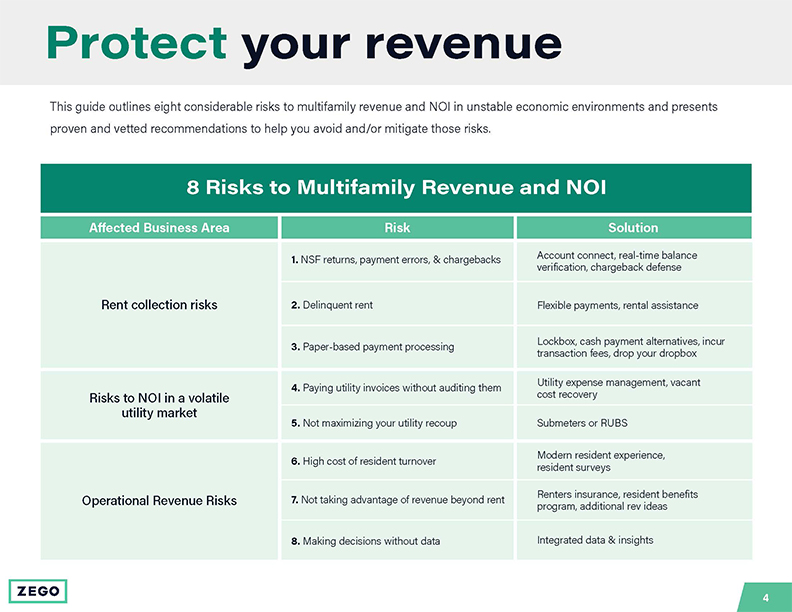

FREE GUIDE

Protect Your Multifamily Revenue: 8 Ways to Mitigate Risk

Potential economic challenges are looming. Learn to identify 8 big risks to multifamily revenue. These proactive steps and proven recommendations will help defend against chargebacks and returns, utility theft, growing resident turnover costs, and more!

What is a rent payment chargeback?

A rent payment chargeback is a cardholder-initiated dispute filed directly with their financial institution. Application and rent payment chargebacks can be initiated for various reasons, including fraud. In the world of e-commerce, this is sometimes referred to as ‘friendly fraud.’

A common scenario is when a customer uses their credit card to purchase an item either in-store or online. After they have received the item, the cardholder will ask their bank to cancel the transaction. This not-so-‘friendly’ process now holds the merchant accountable, regardless of any steps they may have taken to verify the transaction.

In the multifamily industry, chargebacks are most often associated with rent payments and application fees. Let’s examine a few scenarios, and the chargeback protection strategies property managers can use to reduce them.

What are the types of chargebacks in property management and why do they occur?

There are various reasons why chargebacks can occur in property management. The majority of them (around 81%) are related to fraudulent returns, and are typically initiated about 120 days after the transaction.

Some common reasons for credit card chargebacks in multifamily include:

- Delayed refunds

When a renter requests a refund from their property management company and feels that it’s not being issued quickly enough, they may initiate a chargeback.

- Accidental or duplicate payments

Chargebacks can occur when renters accidentally submit duplicate payments or payments in error.

- Auto-payments not canceled

If a renter moves out but forgets to cancel their auto-payments, it can result in a chargeback.

- Domestic confusion and disagreements

A young couple who live together shares a payment portal account, which has both of their credit card information stored. They break up on bad terms, and the boyfriend moves out of the apartment.

The girlfriend could easily pay the rent online using her ex-boyfriend’s saved credit card information. The ex-boyfriend will likely decide to file a chargeback because he never authorized his card to be charged.

- Unknown charges

Typically younger residents, like those living in student housing, will use a family member’s credit card to pay their rent. The student’s grandma, grandpa, aunt, or whoever owns the credit card doesn’t recognize the charge and files a chargeback.

- Application fraud

When a potential renter’s application is denied, they may contact their credit card company to dispute fraud. This holds the property management company accountable regardless of any verification steps taken.

If we give them the benefit of the doubt, it’s also possible that after applying for multiple properties, this person did not recognize the application fee charge and assumed it was fraudulent.

No matter the reason for the application or rent payment chargeback, you’ll still have to sacrifice your time and efforts to fight and resolve it. And losing chargeback disputes could make a notable dent in your bottom line.

Resolving rent chargebacks are costly and time consuming

Dealing with credit card chargebacks can be both costly and time-consuming for property managers. For every dollar associated with a fraudulent chargeback, it can end up costing you $2.40 in labor costs, including the time spent by your staff to track down the resident and gather all the required challenge documentation. For example, a $100 chargeback can result in labor costs of $240.

Reduce and prevent rent chargeback disputes at your communities

With Zego Pay’s Revenue Protection features, your company gains an experienced partner to fight on your behalf when chargebacks occur. Schedule a demo with Zego today to see how we can provide powerful safeguards against chargebacks, NSF returns, fraud, and errors.

What is credit card chargeback protection?

Credit card chargeback protection helps you reduce the amount of application and rent payment chargebacks you receive, and win the ones you have to fight.

Here are a few tips to help protect against rent chargebacks:

- In reference to the above domestic confusion and disagreements make sure you have the name and signature of every single person living in each apartment on each official lease (including anyone who may claim to be “crashing” for a while).

- Have a blanket electronic payment authorization form in your lease packet. Even though residents click the “I agree to the terms and conditions” button during the online payment process, it’s best to have a tangible agreement with their signature on it as a backup.

- Along the same lines, ensure that residents know their application or deposit payments are non-refundable. Also, have that in writing with a signature or initials.

Pro tip: In the case of a chargeback, the credit card company will ask for proof that the cardholder/applicant was made aware of your no-refund policy.

- If you receive an insufficient funds notification from a resident’s eCheck payment, do not let them pay with a credit card. Or if you do, be on high alert for a chargeback from that person. Be on the lookout for residents whose names don’t match the credit cards they are using. Also, keep an eye on residents who add more than two or three credit cards to the saved payment methods section of their account.

You can only do so much to reduce the number of chargebacks you receive. But if you are skeptical of a resident, the surefire way to avoid a chargeback is to only allow payments in the form of verified funds, meaning cash or money orders.

How to accept verified funds digitally to protect against credit card chargebacks

The good news is that accepting cash or money orders doesn’t mean you can’t accept 100% of your rent payments digitally. Look for an online payment provider that can convert paper transactions into digital transactions.

Zego’s CashPay solution helps with this. CashPay lets residents electronically pay rent with cash at participating retailers nationwide. Once the payment has been made, there is no way for the resident to dispute it.

Additional steps to protect against chargebacks in multifamily

There are several steps you can take to effectively prevent, challenge, and win chargeback disputes that stem from application or rental payments. Here are some recommendations:

- Require applicant signatures

Make sure all your applicants sign a form acknowledging your no-refund policy. Check your application form and ensure that the policy is clearly stated and has a signature line or initial line next to it. This ensures that the credit card company recognizes the agreement with the policy.

- Require verified funds in certain cases

If you have any doubts about a resident, you can ask them to pay with verified funds such as cash or money orders. Zego can also assist you with this process.

- Keep all required documentation accessible

Store all necessary documentation, such as applications, credit reports, leases, ledgers, photocopies of driver’s licenses and pay stubs, and signed payment authorization forms, in an easily accessible manner. This information is usually required by the credit card company and will be essential when disputing a chargeback.

- Encourage residents to research unrecognized charges

If a resident contacts you about an unrecognized charge on their bank statement, advise them to contact their credit card issuer to resolve any discrepancies.

The credit card company will then contact you for additional information, and providing a receipt and description of the charge can often resolve the issue without resulting in a chargeback.

- Get notified fast about credit card chargebacks, especially when it comes to older transactions

Cardholders typically file a chargeback within 3 or 4 days of their transaction. But depending on the bank’s rules and regulations, the consumer generally has up to 120 days to file a chargeback. That’s a broad time limit.

Your staff might not be paying close attention to older transactions, which is why it’s imperative that your payment solution notifies you right away so you can immediately begin to fight and resolve it.

- Avoid issuing refund checks for credit card payments

Refunds should ideally be given back to the cardholder through the same electronic payment method they initially used. Refunding via check can create confusion and potentially result in a double refund if the credit card company rules in favor of the cardholder.

It’s best to refund directly to the card whenever possible.

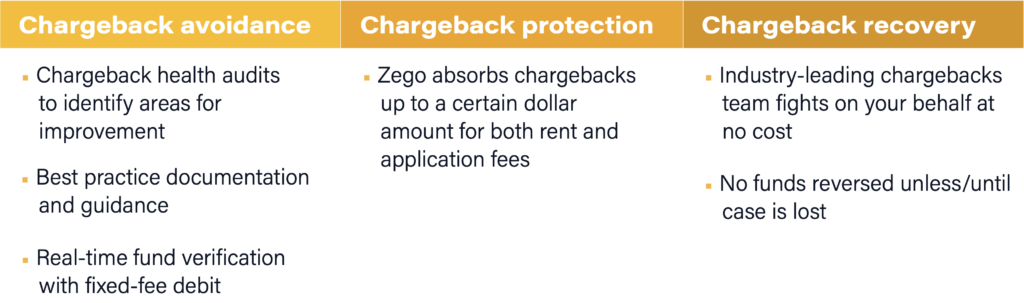

- Work with an expert or chargeback defense team

A chargeback specialist will assist you throughout the entire process. This includes collecting, gathering, and reviewing documentation for the rebuttal. The best payment solutions will have a dedicated chargeback protection team to fight for you around the clock and handhold through the entire process. Make sure the team you choose to fight for you has a high chargeback winning success rate.

If you need a point of reference, the Zego chargeback defense team has a win rate of 82%. Of course, we cannot guarantee any chargeback outcome, good or bad. That’s because it’s solely dependent on the credit card company’s ruling. But from our experience, we can suggest how to protect against chargebacks, and how to win application and rent payment chargeback disputes.

By implementing these steps and working closely with a chargeback defense team, you can effectively minimize, challenge and successfully handle chargeback disputes, saving time and resources for your business.

Winning the War on Chargebacks & Other Rent Collection Risks

In this on-demand webinar, learn how automated systems can protect you and your rent against chargebacks, NSFs, errors, and more. As a potential recession looms, multifamily owners and operators must take action to safeguard revenue now more than ever.

Why work with a credit card chargeback protection team?

Following best practices can help you reduce chargebacks. But unfortunately, chargebacks are inevitable if you accept credit card payments. That’s why you need to have the right partner with the right tools to go to war for you. You can greatly reduce the financial and operational costs associated with chargebacks when you have a payment provider that specializes in chargeback protection and recovery.

It’s also crucial to keep in mind that there is a limited timeframe to respond to the dispute. Otherwise, a “no response” reversal will occur from your property’s bank account. You can find this deadline listed at the bottom of each chargeback.

You must submit your challenge to the chargeback prior to the due date set by the issuing bank. Zego goes to great lengths to communicate the documentation you need to provide and when it’s needed.

We have a dedicated team to help protect our multifamily clients against application and rent payment chargebacks by focusing on avoidance, protection, and recovery.

Ready to improve how you handle and fight rent chargebacks?

Customers see a 82% win rate on chargebacks with Zego’s Revenue Protection Suite. How much could you be saving? Get your custom ROI calculation by speaking with a Zego rep today.