How to Collect Rent Electronically: Modern Solutions for Property Managers

Explore how multifamily properties collect rent electronically and what methods provide the most convenience and benefits for both property managers and residents.

As an apartment operator, you’ve probably wondered: “What is the best way to collect rent electronically?” After all, collecting rent is your business’s most important operational aspect.

Unfortunately, many companies don’t have effective practices in place for taking online rent payments. This causes revenue to suffer and sometimes leads to unhappy residents & staff. Of course, you don’t want these unintended consequences. So, it’s important to make sure paying rent is convenient for your residents while providing the right operational benefits to your company.

Most property management companies find PropTech software the best way to collect rent online. PropTech software enables you to accept digital payments while providing additional operational perks that make rent collection easier.

Electronic rent payments give you a long list of benefits, so they are preferred over paper payments. And when a high percentage of renters pay electronically, the impacts are substantial.

Advantages of electronic rent payments

Faster cash flow

Rent cycles move a lot faster when they are digitized compared to manually processing your payments. That means funds hit your bank account sooner. Shifting to a 100% digital rent payment process can also save property managers significant processing costs—between $3-$10 per paper-based transaction.

When all or most of your renters pay using your rent payment software, you’ll have access to your funds sooner than if they mail in paper checks. Plus, AutoPays and automatic rent reminders increase your percentage of on-time payments. That gives you a domino effect of efficiency and profitability!

A good payment experience for residents

Do your residents ever complain about it being inconvenient to pay you? Do they fumble through your payment platform and decide to write a check instead?

If you answered “yes” to either of those, then you probably don’t offer the best way to pay rent online. The right PropTech solution will give renters a smooth payment experience. This is really important because it impacts resident satisfaction.

Paying rent is a recurring interaction your residents have with you every month. Residents (particularly Gen Z or Millennials) have high standards about online transactions with your company. It has to be convenient for them and give them the flexibility to pay how they want.

If they are inconvenienced each time they make a payment, their frustration will just grow over the course of their lease. And, that may mean they find another community when it’s time to renew their lease.

Reduced workload for on-site teams

You want your teams to focus on resident satisfaction and securing new leases. But processing paper rent payments or dealing with subpar rent collection services keeps them from those priorities.

If you’ve found the best way to collect rent online, your teams aren’t spending time on low-value tasks like entering payment data into your systems or hauling checks to the bank. You also don’t want them rectifying transaction errors that could have been avoided in the first place.

Automating resident payments with tools like online payments, Lockbox, and CashPay reduces manual processing, speeds up cash flow, and fully integrates transactions into your accounting system. This shift allows your team to focus on enhancing resident satisfaction and operational efficiency rather than dealing with paper-based payments and manual data entry.

Better visibility into resident payment data

Pulling and analyzing data is a lot harder to do when you’re manually processing paper checks. Or, if you have an electronic payment solution that does not offer seamless integration or customized reports. The best ways to pay rent online have comprehensive reports that let you quickly find what you need. Bonus points if they point you towards any trends with your payments.

Fewer instances of theft or fraud

Paper-based payments are easy targets for loss or theft. Checks, cash, and money orders are commonly lost while in transit to the bank. And, thieves often target rent drop boxes to steal checks.

If you have the best way to pay rent online, you’ll see fewer instances of theft or fraud. That’s because electronic payments are safer than paper-based ones and less prone to fraudulent activities.

There’s another reason, too. The best digital payment partners also offer services intended to stop nefarious activity. They’ll ensure the bank accounts that residents use are valid before a transaction can run. And, in the event of a chargeback, they’ll fight the case on your behalf.

FREE GUIDE

The 2024 Rent Payment Trends Report

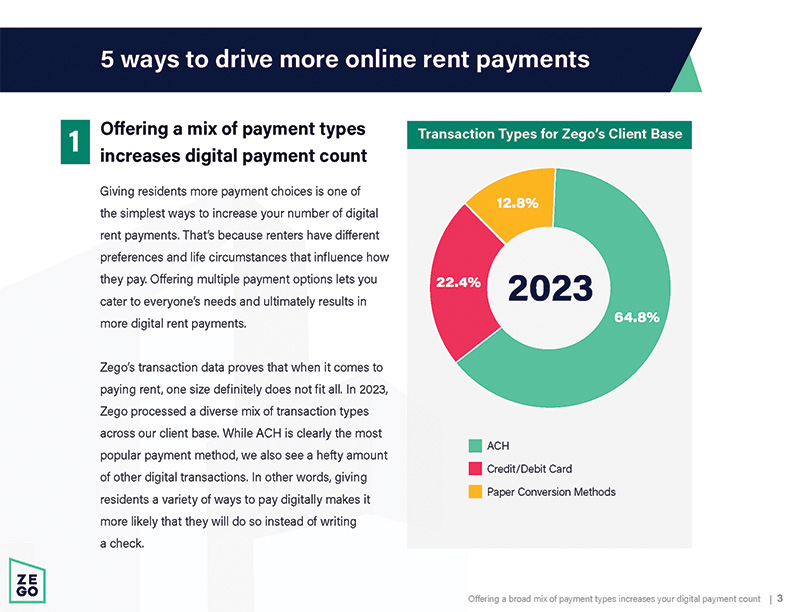

Learn the most effective methods to increase digital rent payment usage amongst your residents with our 2024 Rent Payment Trends Report. Based on research into our user data, this free report details the top 5 data-backed ways management companies are digitizing their rent collection cycles.

Implementing electronic rent payments for efficient operations

In the fast-changing world of multifamily property management, moving to digital solutions is like upgrading your toolkit—it makes everything smoother and enhances how residents experience your property. Picking the perfect property management software for rent collection is key to keeping your competitive edge sharp.

Choosing and using the right electronic rent payment tools or mobile app is about finding what fits your residents’ diverse needs and ensuring it flows perfectly with your current property management software. You want solutions that are easy for residents to navigate but also packed with robust features that make your job easier.

Your tech stack should address things like the hassle of manual payment processing and any gaps in communication with residents. Including a range of payment options is key—this helps cater to different preferences and turns old-school paper transactions into quick, secure digital ones.

And don’t forget, the seamless integration with your core accounting software isn’t just a nice-to-have—it’s essential. This harmony ensures that all financial details and transactions flow smoothly, increasing accuracy and lightening your admin load. By picking software that meshes well with what you already have, you minimize disruptions and make rent collection as efficient as possible.

Leveraging technology for ways to pay rent electronically

You might already be collecting rent payments online. After all, there are many solutions on the market designed for multifamily rent payments. But some solutions lack key features that help you collect rent efficiently. If you want to have the best way to collect rent online, your solution needs to provide the following features:

A mobile rent payment app for on-the-go flexibility

To provide the best experience for your residents, choose a mobile-first community app with a simple workflow that will allow your residents and staff to complete their tasks quickly and efficiently. Rent payment apps give communities a boost in digital payment adoption. You might be surprised to learn that the average multifamily property only receives 30% of its rent payments digitally. Lincoln properties, one of the top 50 multifamily companies in the US, enjoys a 72% digital payment rate thanks in large part to their mobile app.

When looking for an app make sure it’s:

But your app should not just be a payment app. The better, more comprehensive apps include other features such as utilities, resident communications, package management, amenity reservations and integrated work orders. The more features you can pack into a single app the better your adoption rates are going to be. And the happier your residents are going to be when they can manage their entire living experience from a single community app.

Payment options beyond ACH and credit cards

When you offer digital payment methods, your residents will usually opt to debit their bank account (ACH) or use a credit card. But there are other digital payment options you need in your lineup. That way, all of your renters’ payment preferences are available.

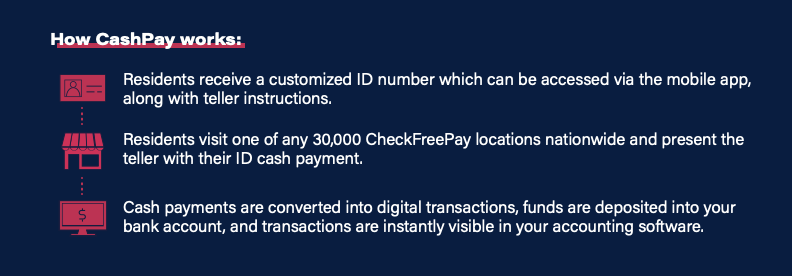

An important payment choice to have is a CashPay solution. CashPay solutions cater to renters who need to pay with cash or a money order. And since 1 in 10 adults is unbanked, you need a way for them to pay you digitally. Here’s how it works:

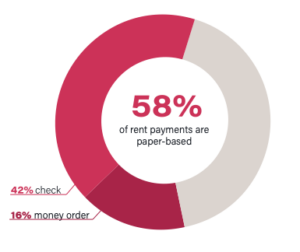

Solutions to convert paper payments into digital transactions

Most property management companies still receive checks every month even if digital payments are an option. In fact, the Federal Reserve Bank of Boston found that 58% of rent payments are still paper-based payments. The best ways to collect rent online will offer solutions that convert any checks you receive into digital transactions.

One way to do this is with lockbox services. Take Zego Pay Lockbox, for instance. This service has renters mail their checks to a PO Box. The box is monitored daily by our payment processors. Any checks received are scanned and integrated into your Zego portal.

This is a key feature because it saves your on-site teams from manually processing them. That’s a big time saver for your associates. Plus, converting your checks into digital transactions will speed up your funding time.

Mobile CheckScan is another feature that helps you convert paper payments into digital transactions. It’s a simple process that is easy for renters and relieves on-site associates from processing checks. With a Mobile CheckScan solution, residents use their community app to make a payment. They take a photo of their check and the bank account information is automatically captured for an immediate payment. Residents can also save the account information for future payments or recurring AutoPays.

You can also offer flexible rent payments, a feature that allows residents to split their rent into smaller, stress-free payments throughout the month. Zego partners with Best Egg to pay your properties in-full and on-time on the resident’s behalf. Best Egg then allows the resident to create a custom payment schedule at an affordable monthly membership price.

Enhancing electronic rent payments with communication and incentives

Effective communication about how to pay rent is critical. That includes how and when rent should be paid, and information about your payment portal information or app. Make sure to give renters this information before move-in so they have clear expectations from the start.

Here are the 3 channels to focus your marketing efforts to encourage digital payments as soon as move-in:

- The lease

Let your residents know early on about their payment options. Add a payments clause to your lease or rental agreement, and go over the details with each new resident. List all of the acceptable forms of payment, but accentuate the fact that digital payments are preferred. - Fliers, letters, and other print materials

Although paperless is the ultimate goal, the effectiveness of print marketing, in some cases, cannot be denied. Consider including information about your payment portal in print materials such as your new resident move-in packet, welcome letter, signage directing residents to make a digital payment instead, etc. - Digital communications

Your resident marketing program should include communications via emails, texts/sms (for those who opt-in), and in-app push notifications. Onboard new residents with instructions on how to use your payment portal. Use digital communications to deliver a stream of practical information while being careful not to overwhelm or “spam” them.

Providing incentives, such as gift cards or credits towards next month’s rent for signing up for AutoPay, further motivates residents to choose digital options. Absorbing the digital payment processing fees can also remove financial barriers, making the transition smoother for residents.

Offering a free credit reporting feature for on-time rent payments can be a powerful draw, helping residents see the value in consistent electronic payments and contributing to their financial wellbeing.

Rental Credit Reporting

A lot of people are surprised to learn that rent payments are not automatically reported to the credit bureaus. And it’s a shame because for most renters it’s the largest monthly payment they make. Reporting those monthly payments can help people establish a credit history which is critical for making large purchases like a car or house.

Find a provider that offers rental credit reporting so you can help your residents build their credit histories with their on time rent payments. This can differentiate your properties from others and provide a powerful incentive and draw for your residents.

And it’s easy. In order to report rent payments to credit bureaus, residents simply opt-in to the program within their online payment portal. From then on, each time the resident makes a rent payment through your system, your payment provider will automatically report that payment to the credit bureaus along with any other digital rent-related payments.

Streamlining operations with electronic rent payments

Adopting electronic rent collection enhances operational efficiency and resident satisfaction. It’s an easier payment process for residents, boosts security, and creates better cash flow. By choosing a solution that fits your residents’ needs and integrates smoothly with your current systems, you optimize both functionality and user experience.

If you want to collect more rent payment electronically, check out our digital payment adoption checklist. It covers all your bases including staff training, resident onboarding, diversifying payment options, and engaging residents effectively. Embracing these digital tools not only meets modern property management demands but also significantly improves your community’s operational dynamics and resident interactions.

Ready to improve your digital payment adoption?

To learn how we can help you implement these best practices, schedule time with Zego and explore the robust features of Zego Pay tailored to boost your digital payment adoption.