How to Collect Rent Payments: Effective Strategies for Property Managers

Improving the rent collection process makes property operations more efficient, gives you better cash flow, and improves the resident payment experience. Read our tips for optimizing how you collect rent.

For property managers, optimizing the rent collection process is vital. By doing so, you’ll provide residents with a secure and convenient way to pay rent, while also improving your cash flow and business operations. Whether it’s incorporating digital options or simplifying traditional methods, you want the process to be as efficient as possible. And with the right rent payment technology and strategic practices, you’ll see smoother operations and improved resident satisfaction.

We’re going to share some proven methods to enhance rent collection in multifamily properties, and give practical tips that will streamline your operations. By adopting these strategies, you can ensure that both your rent payment cycles and your residents’ experiences are seamless and hassle-free.

Enhancing Rent Collection Methods

Choosing the Right Technology to Collect Rent

Having the right technology to collect rent is crucial. Your rent payment platform not only needs to meet resident expectations, it must also enhance the overall efficiency of your rent payment cycles. To make the payment experience seamless for your residents and to improve your business operations, you’ll need to consider the following things about your rent payment platform.

- Digital Platforms: Online payment portals and mobile apps offer a variety of features that improve rent collection. These platforms can offer automated rent reminders, multiple payment options, and instant payment confirmations, minimizing the risk of delinquencies and reducing administrative burdens.

- Integration: Ensure that the digital solutions you choose integrate seamlessly with your existing accounting and management software. This gives you accurate and up-to-date financial records and simplifies the reconciliation processes.

- User Experience: Opt for interfaces that are user-friendly and accessible. An intuitive design makes the payment process easier for residents, making it more likely they’ll use digital payments when it’s time to pay rent.

Leveraging technology like Zego Pay can be a game-changer in automating and optimizing rent collection. These technologies not only support various payment methods, but also integrate into your accounting software, ensuring smooth operations and accurate tracking.

FREE GUIDE

The 2024 Rent Payment Trends Report

Learn the most effective methods to increase digital rent payment usage amongst your residents with our 2024 Rent Payment Trends Report. Based on research into our user data, this free report details the top 5 data-backed ways management companies are digitizing their rent collection cycles.

Diversifying Payment Methods

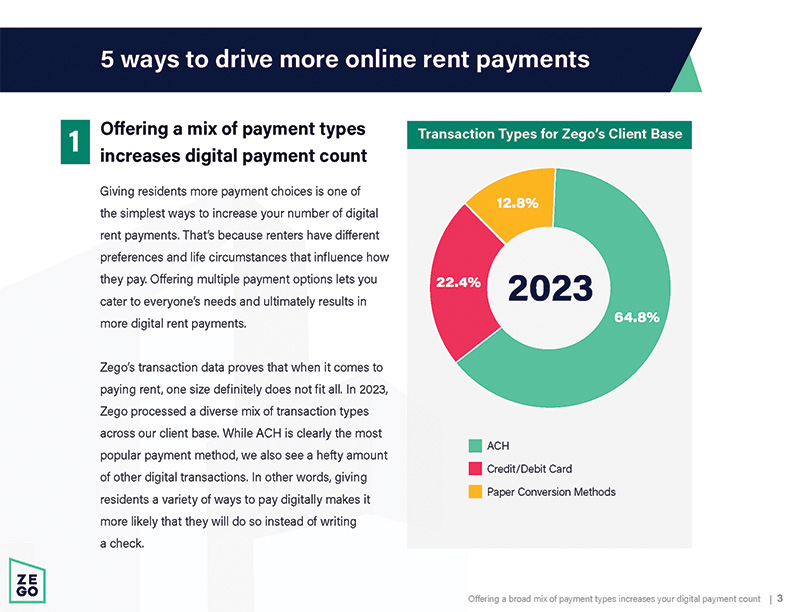

Zego’s 2024 Rent Payment Trends Report revealed that diversifying payment options significantly increases digital transactions. Accommodating different resident payment preferences lets renters pay the way that’s most convenient for them. And in turn, it significantly enhances the rent collection process because more payments can be processed digitally. Here are some strategies to diversify your payment mix:

- Multiple Digital Options

Make sure to provide a variety of digital payment options such as ACH, credit/debit cards, as well as mobile payment apps. These methods not only speed up the transaction process but also allow for better tracking and security. Implementing an integrated digital payment system can also reduce errors and manual processing, leading to a more seamless rent cycle.

- Cash and Check Payments

While digital payments are on the rise, it’s crucial to continue accommodating residents who prefer traditional methods like cash and checks. With tools like Zego’s CashPay, Check Scanning and Lockbox, property managers can seamlessly convert these paper payments into digital transactions. This improves both security and funding time.For cash, residents can pay at designated retail locations and their payment is immediately digitally routed to the property manager’s bank account. For checks, residents have the option to use their mobile devices to scan checks, which are then digitally processed. Alternatively, checks can be mailed to a secure P.O. box, where they are quickly processed and the payment information is digitally updated in the property management system.

By modernizing how cash and checks are processed, you gain faster processing time, reduce the risk of errors, and enhance security by minimizing the physical handling of money.

- Flexible Rent Payments

Offering flexible rent payments greatly benefits residents by allowing them to tailor their rent payment to their financial situations. This approach can minimize late payments and financial stress because residents can make smaller, more manageable payments throughout the month. It can also increase resident satisfaction and loyalty since residents value flexibility and convenience from their property management company.

Ensuring Timely Rent Payments

Automating Rent Reminders and Collection

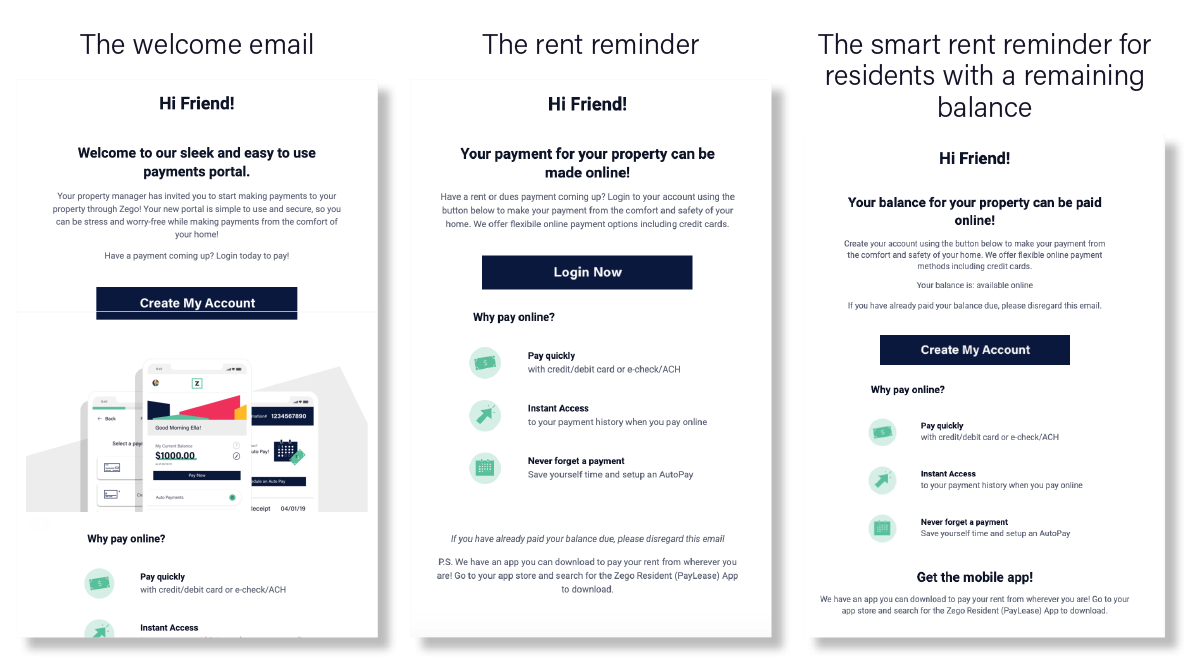

Automating rent reminders and collection processes can significantly improve how your company collects rent. Using automated systems, residents receive reminders about upcoming or overdue payments. You can also do segmentation based on prior resident activity (smart reminders). Below are a few examples.

By linking these automated systems with your accounting software, reminders can be automatically triggered when a resident’s ledger shows a balance due. Automated reminders can be sent via email, text, or push notifications, depending on the residents’ preferences, making it one of the easiest ways to collect rent. Using rent reminders not only helps reduce late payments, but also enhances cash flow.

In addition to automated reminders, you need to automate the actual payment process for residents. When residents are able to set up automatic payments, property managers see fewer late payments along with lower administrative costs associated with manual payment processing. This automation ensures a more reliable and consistent cash flow, which is crucial for the financial health of your property.

Enhancing Resident Engagement and Incentives

Another way to improve your rent collection process is by engaging residents and offering incentives. Here are some resident engagement strategies to consider:

- Educate Residents: Give residents clear instructions and support on how to use your payment system. This could include email guides, video tutorials, or live walkthroughs of your payment portal or app. You also want to communicate that digital payments are the preferred method of paying rent.

- Rental Credit Reporting: Offering residents the ability to have their rent payments reported to credit bureaus is a significant incentive. This service helps residents build or improve their credit scores, providing them with tangible benefits for their financial stability. Implementing this feature can also help attract and retain responsible residents who are interested in enhancing their credit histories.

By implementing these varied methods, property managers can ensure efficient rent collection and foster a positive relationship with their residents, ultimately leading to more timely payments and a smoother operational flow in their properties.

Action Items

How to Effectively Manage Rent Collection Challenges

Mitigating Financial Risks

When it comes to how to collect rent payments, managing financial risks is something you can’t overlook. This is especially important when it comes to chargebacks and non-sufficient funds (NSFs).

Chargebacks can arise from various scenarios in property management, such as delayed refunds or misunderstandings over charges. Resolving a chargeback often leads to significant administrative strain. For each dollar lost to a chargeback, the cost to the property manager can escalate when accounting for labor involved in resolving these disputes.

NSFs pose another significant challenge. While NSF fees might seem like a minor revenue stream, the administrative burden and the negative impact on cash flow can be substantial. The disruption caused by NSFs, from resolving the issues to recovering funds, typically outweighs any financial benefits from the fees themselves.

To address these challenges and enhance how you collect rent, consider leveraging revenue protection services through your rent payment software. This can substantially minimize these financial risks. Revenue protection services authenticate bank accounts and verify funds in real-time. Ensuring that accounts are active and sufficiently funded before processing the transaction significantly reduces the incidence of NSFs and chargebacks.

It can also preemptively reduce delinquencies. Thoroughly screening potential renters by analyzing their income, credit data, and employment stability can help in selecting residents who are less likely to default. Additionally, offering flexible rent payment options can accommodate residents’ varying financial circumstances, preventing overdue payments before they occur.

Educating Staff

Training your staff about your rent collection service will minimize disruptions during rent cycles. Educating them isn’t just about the operational aspects of how to collect rent. You also want team members to understand the underlying value of your rent payment technology. Companies that devote significant time and resources to training typically see better overall adoption rates of payment systems and encounter fewer issues.

- Ongoing Education: It’s important to regularly update training materials and sessions to reflect the latest features and changes in your rent collection systems. Continuous training helps bridge any knowledge gaps that might arise from staff turnover or updates to the system.

- Training Resources: Utilize a variety of materials to keep your teams well-informed on how to collect rent.

- Video Tutorials: Video tutorials and/or webinars provided by your rent payment vendor will help train new staff and give existing staff a refresher. These resources should be easily accessible and included in your training library.

- Manuals and FAQs: Regularly update and distribute manuals and FAQs that address common questions and scenarios that your staff might face during the rent collection process.

- Examples of Zego resources for property staff

- Video: 3 Tips to increase digital payment adoption

- Zego Onboarding: Training webinars & recordings

- Infographic: 10 Ways to kickstart digital payments

- Interactive checklist: The digital payment adoption checklist to collect rent online

Setting Goals and KPIs

Effective training involves not only educating staff, but also motivating them to be proactive in improving rent week cycles.

- Goal Setting: Establish clear, measurable goals for your team to achieve. These could range from increasing digital payment adoption to reducing the number of payment delinquencies.

- Monthly or Quarterly Benchmarks: Set realistic benchmarks that encourage staff to continually improve their performance. Celebrating these achievements can boost morale and incentivize staff to strive for higher goals.

- Incentives: Consider giving rewards to team members who meet certain targets. Incentives can be anything such as team lunches or small bonuses and can boost their motivation and commitment to achieving goals.

- Tracking KPIs: Monitor key performance indicators (KPIs) to evaluate the effectiveness of your training and rent collection strategies. KPI’s you can track include:

- Boost digital payment adoption from 20% to 80% by the end of the year

- Increase portfolio-wide adoption by X%

- Increase individual property adoption by X%

- Get X amount of AutoPay sign-ups

By investing in continuous training and setting clear goals, your on-site teams will be motivated to streamline how you collect rent. These challenges also support staff development, leading to a more skilled and effective team.

Improving rent collection processes yields valuable results

Modernizing your rent collection strategies will greatly increase the operational efficiency of your apartment community. But first, you need to implement the right technology and strategies for collecting rent.

From automating rent reminders, to educating staff, and mitigating financial risks, these actions improve the efficiency of your rent collection process. And the benefits don’t stop there. Using these tactics, you’ll give residents a more convenient way to pay rent, and solidify financial operations at your property helping you become more profitable.

Ready to improve the way you accept rent payments?

To learn how we can help you implement these best practices, schedule time with a Zego team member for a quick demo of Zego Pay.