Property management digital payments: 5 ways to modernize multifamily receivables

Learn how to modernize your receivables process & boost property management digital payments across your portfolio with a proven set of best practices.

Fortunately, the vast majority of property management companies now offer at least one digital payment option and enjoy the efficiency and expedited cash flow that accompanies those transactions. But the Federal Reserve Bank of Boston found that 42% of rent payments are still made with a check and 16% are made with money orders. And accepting even a small percentage of paper payments puts your revenue at risk.

Most multifamily firms want an online rent payment system that is not only secure, seamless, and integrated with their property management software, but they’re also looking for a partner to help them achieve 100% digital payment adoption.

At Zego, we’re hyper-focused on empowering our clients to get more residents to pay rent online. This saves their staff time, speeds up their cash flow, and improves operational efficiency. So, we launched a research study to find out what our clients with the highest adoption rates are doing differently. During the study, we found that they were proactively driving property management digital payments through these 5 key strategies:

- Train staff on your payments system: Provide “on-demand” training for your on-site associates around the value and the functionality of your property management digital payments system.

- Revamp resident onboarding: Update the information you give new residents, and set clear expectations around when and how payments should be made.

- Offer resident incentives: Set up a win-win payment structure that benefits both you and your renters.

- Provide multiple payment options: Offer at least four different methods to pay online, including a cash payment alternative. Top achievers also use lockbox services to convert checks into digital transactions.

- Bolster resident engagement & communication: Ensure your community engagement technology is up to date.

What could you do with five extra hours each day?

By automating payment processing, you can build over five hours back into one on-site manager’s eight-hour day. Speak with a Zego expert to learn how you can achieve 100% paperless payments processing while providing residents flexible payment options.

Step 1. Train staff on your property management digital payments system

You can’t install new property technology, train your staff once, and never think about it again. A periodic review of best practices is necessary in order to keep up with new features and updates.

Provide an on-demand training arsenal for your team

Property staff are typically stretched far beyond their job description. They’re constantly learning new solutions, especially if you took advantage of self-guided tours, package management systems, virtual community events, and more during the COVID-19 pandemic. All of these added responsibilities come with an abundance of available resources and technologies (i.e. Zoom, resident apps, package lockers, etc). It’s overwhelming.

So, when it comes to training, it’s important to be inventive with new methods and media that excite your staff. Empower them with the tools and support they need to confidently explain how your property management digital payments system works. Provide access to on-demand trainings, webinars, links to collateral, and updates on new info when it becomes available.

Zego’s sample resources for property management digital payments training

- Video: 3 Tips to increase digital payment adoption

- Zego Onboarding: Training webinars & recordings

- Infographic: 10 Ways to kickstart digital payments

- Interactive checklist: The digital payment adoption checklist to collect rent online

Use KPIs to drive more property management digital payments

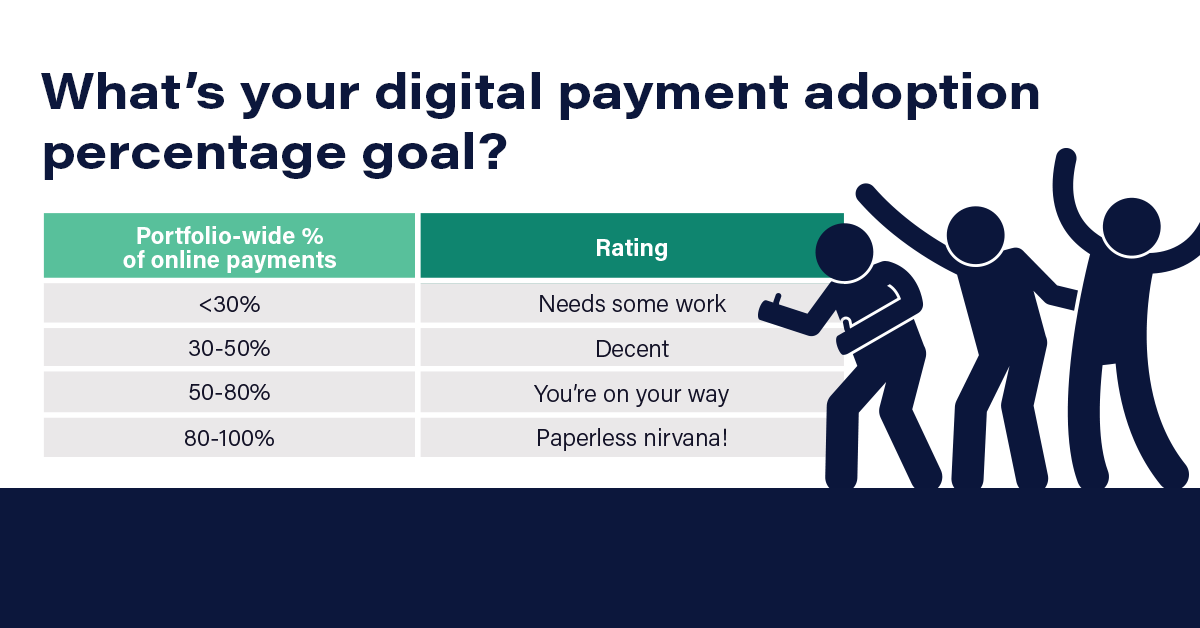

Hold teams accountable with Key Performance Indicators (KPIs); measurable values that demonstrate the effectiveness of your team’s efforts. Start off by setting a goal for your desired percentage of digital payments across your portfolio.

Here are a few additional KPIs you can track (fill in the X with your company goal):

- Boost digital payment adoption from 20% to 80% by the end of the year

- Increase portfolio-wide adoption by X%

- Increase individual property adoption by X%

- Get X amount of AutoPay sign-ups

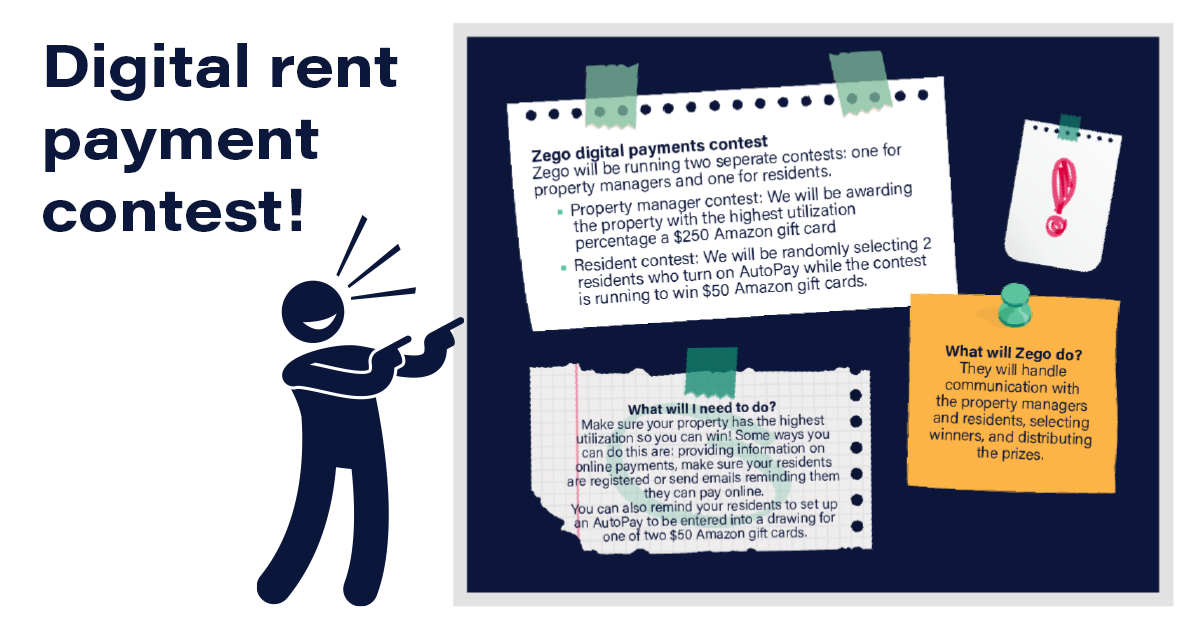

Run contests for site staff and residents

At Zego, we see the best results when our clients run contests for both residents and property staff. Check out how Kingsley boosted their digital payment adoption from 64% to 81% with the help of two payment contests.

Kingsley’s Contest Experience

Kingsley’s Contest Experience

Kingsley Management Corporation ran two payment contests to drive property management digital payments. The contests ran simultaneously over the course of three months across their entire portfolio (over 18,000 units). Any resident who paid rent via AutoPay during those three months was entered to win a $500 credit towards their next payment.

The results

Their overall percentage of property management digital payments increased from 64% to 81% after successfully running two contests. Now, their on-site team spends less time on manual payment processing, and more time engaging with residents.

“We want to let our on-site staff focus on their park’s needs, and not spend their time collecting and inputting checks,” says Dakota Green, a member of the technical support team at Kingsley. “We have one park in California that went from 0% to 100% utilization in about 3 months. She told their residents they would no longer accept checks. It was a night and day difference. She has so much more time to focus on the park’s needs.”

FREE DOWNLOAD Download The Property Manager’s Guide to Common Rent Payment Mistakes to identify ways to improve your rent collection process and get paid faster.

What are the top mistakes that property managers make when collecting rent?

Step 2. On-board residents to your property management digital payments platform

How are staff communicating with new residents about your property management digital payments system? Providing support and setting expectations at the start of the lease is the most efficient way to boost digital payments at your community.

Effective resident outreach

Our clients have found that digital methods such as email, text, and in-app messaging are the most successful and cost-effective way to educate residents about their online payment options. Emails are trackable, customizable, and allow residents to activate their account with a click. That’s why top performing management companies set up automated email flows for new residents. Here is a sample move-in email schedule:

Wondering what content to include in your emails? Almost 5 billion videos are watched on YouTube every day. For the residents who are likely to skim over a block of text, include an explainer video (like the one below) in your email messaging:

Set clear expectations around your property management digital payments

In addition to email marketing, there are three important steps along the prospect-to-resident journey to encourage digital payments. Those areas of focus are the application fee, the lease, and the move-in packet.

Application fee

Whichever payment method residents use for their application fee is most likely what they’ll continue to use throughout the duration of their lease. Only accept digital payment methods for your application fee to get residents accustomed to your property management digital payments system.

Lease

- Add a payments clause to your lease or rental agreement, and go over the details with each new resident.

- Let them know right off the bat that you do not accept cash for rent payments, but you do accept a digital solution for cash payments.

- List all of the acceptable forms of payment, but accentuate that digital payments are preferred.

Move-in packet

- In your new resident move-in packet, include a brochure with registration instructions for your payment portal, an AutoPay enrollment form, and promotional materials.

- Make sure they know how to download your app and log into your digital payment portal.

- Include digital payment instructions in your welcome letter.

- Shutter your dropbox and hang signage directing residents to pay online instead.

Step 3. Offer the right resident incentives

How can you create a win-win rent collection strategy that benefits both you and your renters?

Choose the best pricing model for your portfolio

To discover which pricing model is right for your portfolio, check out our blog, Electronic rent payment pricing models explained. It provides a deep dive into the pros and cons of three different property management digital payment pricing models. Here is a short summary of those pricing model options:

- Standard passed: When residents pay online, they also pay the processing fees.

- Standard incurred: The property management company pays the digital payment processing fees on behalf of their residents for one or more payment types (i.e. ACH only, or ACH and credit card).

- Subscription ACH: The management company will pay a small, monthly per-unit fee that includes all ACH transaction costs no matter how many residents pay online. It’s a subscription model that works best for management companies with over 50% digital payment adoption.

According to the NMHC, 93% of today’s renters want to pay their rent online. But, only 20-30% will pay digitally if there is a processing fee involved. An additional fee on top of rent and other property charges is too tough a pill for renters to swallow, especially when there are free payment apps (i.e. Venmo) available. And while these peer-to-peer apps work well for one-off payments, they lack all the benefits that accompany rent collection software, including a solid integration with your PMS, payment flexibility, reporting tools, etc.

That’s why leading companies choose to absorb the transaction costs on behalf of their residents with either the Standard Incurred or Subscription ACH pricing model. Property management companies that pay the digital rent payment processing fees for one or more payment methods typically find that their digital payment adoption rate doubles.

Roy Rainey of Rainey Realty decided it was well worth it. “We decided to incur the costs of eChecks, which is a nominal cost. We probably pay around $300 per month in the eCheck processing fees. But since everyone pays digitally now, we are not paying a bookkeeper to process rent. The tradeoff is worth it, especially because our system is 100% accurate and we can see all of our payments in real-time.”

Charge residents for paying with a paper check

As long as your residents have a free digital payment option, you have the power to charge a fee to those who still insist on paying with a paper check. A fee will motivate them to pay online instead. Plus, you’ll be compensated for the valuable time it takes to scan, deposit, and reconcile those payments.

Provide an incentive to those who enroll in AutoPay

AutoPays are a win-win. Your residents can “set it and forget it” and enjoy the convenience of having their rent paid on-time automatically. And you can count on digital payments and a steady cash flow. Because AutoPays are mutually beneficial, why not offer a little incentive? Run an AutoPay contest, offer a gift card to a local coffee shop to residents who pay via AutoPay for three consecutive months.

Or, do what Planned Property Management did and incur the first month’s processing fee on the resident’s behalf. “I would estimate at least 80% of our tenants have used Zego at least once. It is so much easier than writing a check and adoption has grown considerably within our tenant base,” said Mary Francis, Collections Manager at Planned Property Management.

Close off your on-site drop boxes and give residents the flexibility to pay rent their way

The easiest way to eliminate paper checks altogether is to stop accepting them. Close off your on-site drop boxes. But in order to do this, you’ll need to offer a free digital payment method as an alternative.

Another alternative, and to make rent week a little less daunting, allow residents to pay rent in installments with flexible rent payments. Rent is likely your residents largest monthly expense and with flexible rent payments, your properties get paid in full and on time at no cost to you, while residents can pay rent on a schedule that works for their own budget and cash flow.

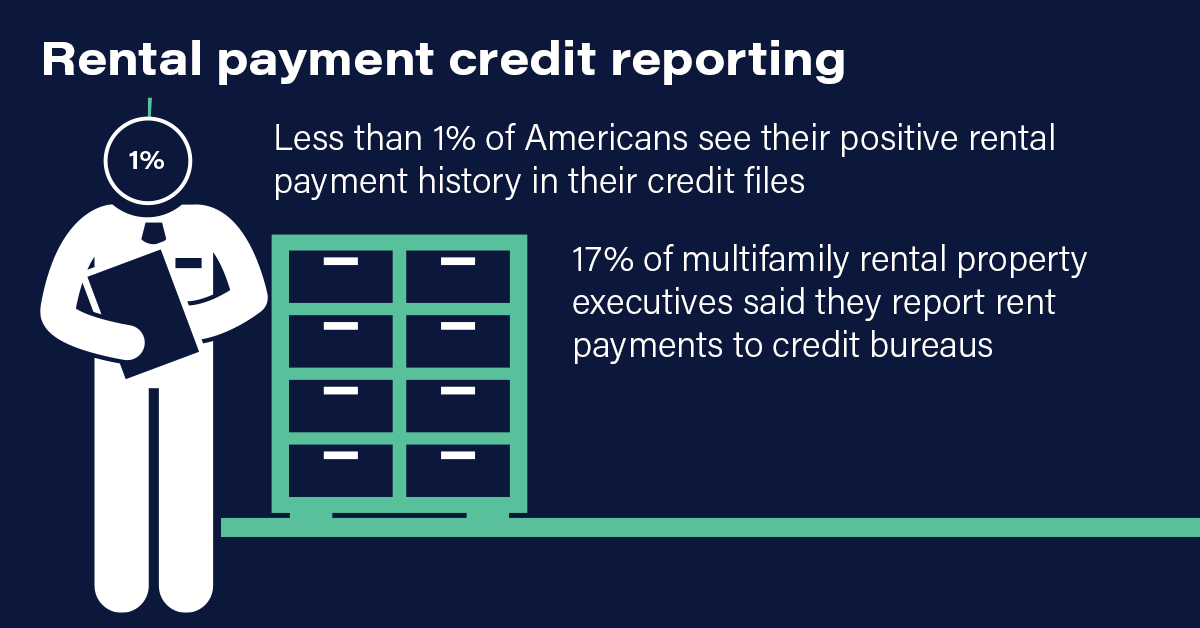

Educate residents on the benefits of property management digital payments

Property management digital payments providers will sometimes offer rental payment credit reporting to your residents as an additional service. This helps improve resident satisfaction and serves as a competitive differentiator for prospective renters. In fact, 17% of multifamily rental property executives said they report payments to credit bureaus, giving you an advantage over the other 83% if you offer this incentive.

The numbers from this TransUnion survey show that rental credit reporting is something that residents are very interested in:

73% of renters would be more likely to pay rent online and on-time if property managers reported rent payments to a credit bureau.

73% of renters would be more likely to pay rent online and on-time if property managers reported rent payments to a credit bureau.- 67% said they would choose the rental unit with reporting already in place when given a choice between two similar properties.

- Residents could increase their credit score by as much as 26 points in one year.

For Zego clients, credit reporting is easy to implement and enjoy.

Step 4. Provide flexibility with your property management digital payments

Residents want flexibility. And flexibility from a payment modality perspective includes the ability to pay rent online by eCheck, credit card, debit card, and even virtual wallets (like PayPal). Going forward, some of the leading payment platforms are working on accepting Apple Pay, Google Pay, etc. The more digital options you provide, the fewer cash, paper checks, and money orders you’ll receive.

Accept all major payment types for your residents

Give residents the ability to pay rent online via your community’s mobile app. In addition, you should accept all major payment types including:

- ACH

- eCheck

- Debit card

- Credit card

- At least one tokenized payment service (PayPal, Apple Pay, etc).

Instantly verify bank account information to reduce payment returns

Bank account linking instantly authenticates bank accounts for payments, creating an easier way for residents to use their bank account to pay rent online. At Zego, our Account Connect feature guides residents through a secure process to automatically link their bank account and ensure accuracy and ease.

Chargeback avoidance, protection, and recovery

Multifamily portfolios can lose tens of thousands of dollars annually due to chargebacks. Best-in-class payment providers will help property management companies avoid, protect, and recover from chargebacks.

At Zego, our Revenue Protection Suite helps our clients with chargeback avoidance, protection, and recovery for all types of payments. From rent to application fees, ACH to credit card transactions, our solution gives our clients chargeback protection and peace of mind.

Convert paper checks to property management digital payments

Mobile CheckScan

One of the innovations we’re starting to see emerge in the industry is mobile check scanning. At Zego, our Mobile CheckScan feature allows renters to scan a check by taking a quick snapshot from their Zego Pay mobile app. From there, they can initiate an ACH payment from that bank account.

Manual check scanning

Check scanners convert checks and money orders into digital transactions, eliminating the time spent transporting checks to the bank, depositing them, and manually posting them to the resident ledgers. Check scanners have gained popularity (especially in senior-living communities), and have become a necessity for communities that still receive a large number of personal checks and certified funds. Here are some check scanning best practices.

Close the door on cash

Stop accepting cash and money orders altogether. Top payment providers offer an alternative cash payment method for unbanked residents.

Our CashPay solution, for example, lets residents pay with cash or debit card at over 25,000 retail locations nationwide. The CashPay transactions appear in the Zego system right away. They also integrate into your accounting software. Residents can even access their CashPay account number within the community app while they’re on the go.

Step 5. Bolster resident engagement and communication

The way residents connect with their community has evolved. Millennials and Gen Z (who now make up over 50% of renters nationwide) have been conditioned to lose patience for clunky, slow, or outdated software. Gen Z actually prefers high-speed internet and digital features over standard amenities like parking garages, gyms, or pools. In a recent study, online rent payments and maintenance requests ranked highest for most-desired digital features.

So how can you leverage technology to improve resident satisfaction and boost your property management digital payments?

Optimize your community app

Beyond digital payments, all-in-one community apps provide additional functionality for features including maintenance requests, in-app communication with property staff, marketplace services, and more. Residents are more likely to pay rent online because they’re already engaging with the app. In fact, a study by Martec found that 46% of residents said they would use a mobile app to pay rent online if they had the option available to them.

Real estate investment firm, S2 Capital, saw a 27% increase in their residents paying rent online after implementing a community app. Lincoln Properties, one of the top 50 multifamily companies in the US, touts a 72% adoption of property management digital payments largely because of their mobile app.

Optimize your website

In addition to being quick-to-load and easy-to-navigate, your homepage should include a link to your payment portal above the fold. Online rent payments double when residents submit their application payments digitally. Are your application portal and payment portal easy to locate on your site?

“Collecting the application payments online 24/7, whether our office is open or not, really was a differentiator for us in the marketplace”

– Diane Caton, Executive Vice President MSC

Schedule automatic reminders to pay rent online

Property managers can reduce late payments without lifting a finger by setting up automated rent reminders to residents in the form of monthly emails, texts, and even in-app push notifications.

After turning on automatic rent reminders for their residents, our clients saw average online rent payment adoption jump to 60% or more portfolio-wide.

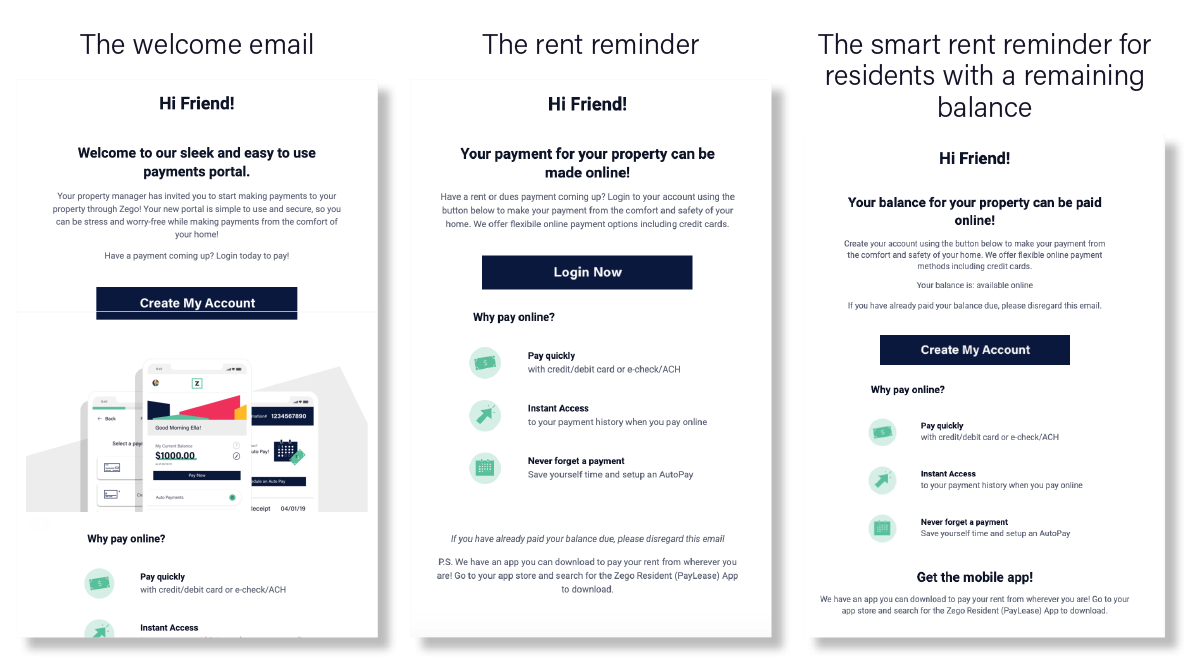

At Zego, we help you collect resident contact information and automate activation and rent reminder campaigns. Our smart reminders will even automatically tailor the messaging based on resident activity such as move-in or remaining balance due. Below are a few examples.

These integrated resident emails provide renters with a tokenized link, which allows for easy, one-click payments and account registrations. These digital communications help to remove friction during the payment process, and move the needle on your property management digital payments adoption.

Need more ideas to boost property management digital payments?

By now, you know that digital rent payments drive efficiency and better cash flow. Zego Pay is designed to help properties achieve 100% paperless payments. Speak with a Zego expert to learn more about our 100% Digital Payments program available to all Zego clients.

Ready to Improve Your Digital Payment Adoption?

To learn how we can help you achieve 100% digital payment adoption, schedule time with a Zego team member for a quick demo of Zego Pay.