What multifamily operators should know about rental credit reporting

Rental payment credit reporting doesn’t have to be complicated. We’ve answered the top 7 FAQs multifamily professionals ask about rental credit reporting.

In this blog post, we’ll cover:

- What is rental credit reporting?

- Who is it for?

- How does it work?

- Is there a demand for it?

- How many communities are currently offering it?

- How do I offer it to my residents?

- What can I do to promote it?

The world of rental credit reporting can be confusing to residents and property managers alike. Many residents are unsure as to whether or not their property management company will automatically report rent to credit bureaus. Residents want to leverage their rent payments (one of their largest monthly expenses) to help boost their credit score. But they don’t realize that in order to do so, they need to opt-in to a rent reporting program. This desire to build credit, but confusion around how it works is exactly why rental credit reporting providers exist.

A random group of 100 millennial-aged Americans (26-40 years old) was asked, “are rent and utility payments automatically reported to the credit bureaus?” Almost 30% answered “yes.” So the issue isn’t that renters don’t want rental payment credit reporting, it’s that a third of them think they already have it.

On the other side of the coin, apartment operators wonder if it’s an amenity that will help differentiate their property. Or if it will simply pile more work onto their plate. Confusion around how to market a rent reporting program to current and prospective residents is another common concern.

But rental payment credit reporting doesn’t have to be complicated. We’re answering the most frequently asked questions we hear from our Zego™ (Powered by PayLease) clients about this additional service. Please feel free to use our interactive table of contents to skip around the article.

Already an expert? Offer rental credit reporting to your residents for FREE when you sign-up for Zego™ Pay!

1. What is rental credit reporting?

So what is rental credit reporting? It’s a program or service that will report rent payments to credit bureaus with the goal of boosting an individual’s credit. As a rapidly growing trend in the multifamily industry, it not only offers a game-changing incentive for residents, but also benefits the property management companies that provide it as an amenity. It’s a win-win for all parties involved. Property management companies gain a competitive advantage to attract responsible prospective renters. And residents have the chance to catapult their credit score from ‘poor’ to ‘excellent’ simply by paying their rent.

2. Who is rent reporting for?

Rental credit reporting benefits all renters of any portfolio type (such as student housing, conventional market rate, affordable housing, senior housing, etc.), regardless of social and economic status.

3. How does rental credit reporting work?

Let’s break down the rental payment credit reporting process step-by-step.

Step 1. Provider set-up

The property management company works with an online payment provider to offer rental credit reporting to their residents.

Step 2. Residents opt-in

Residents individually opt-in to the program within their online payment portal or app.

Step 3. Rent payments are reported

From then on, the program will report the resident’s rent payments paid via the payment provider to credit bureaus, along with any other digital rent-related payments.

Step 4. Optional back reporting

Most rental credit reporting providers also allow residents to enroll in a “look back” program that back-reports any payments made during the previous 24 months.

Pro tip: This additional service typically costs a flat fee of around $49.95 per resident.

The results?

Advertisements from Credit Karma, Experian, and similar companies boast that their clients’ average score increased 9 points, 11 points, or maybe even 13 points. Kudos to them, that’s excellent. But, studies show that rent payment reporting can see an average increase of over 30 points in just a few months! And in a few rare cases, rental credit reporting clients have achieved over a 250 point increase to their credit score. Not to mention consumers with no scores end up scoring by adding a rental tradeline.

FREE DOWNLOAD Download The property manager’s guide to 100% online rent payment adoption to learn how rental credit reporting is a great incentive for online payments.

Want to boost digital payment adoption?

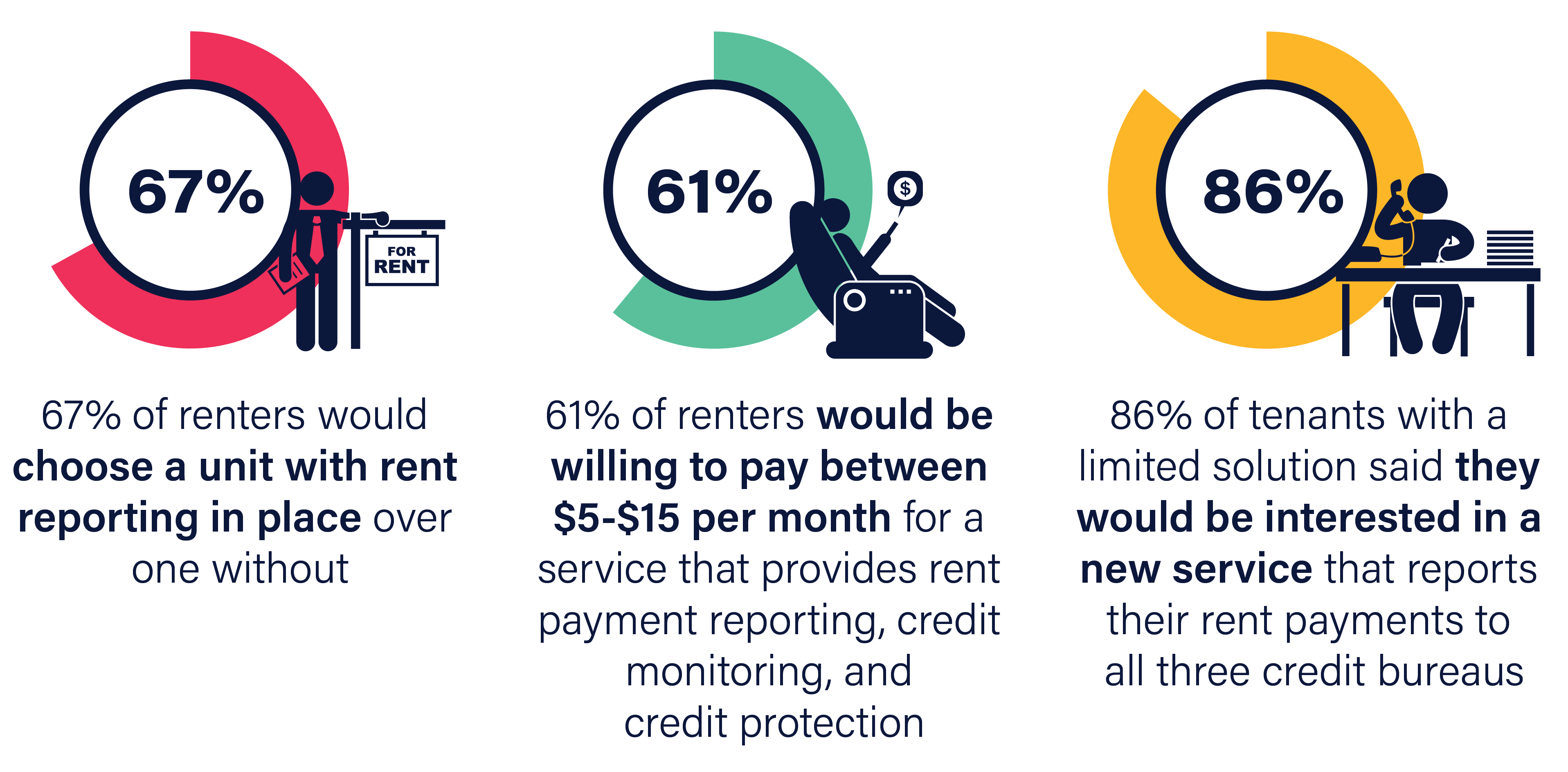

4. Is there a demand from residents for rental credit reporting?

With all of the benefits rental credit reporting has to offer, the number of communities currently offering this amenity is surprisingly low. The increasing demand for this valuable service is not being met in the residential real estate market.

In fact…

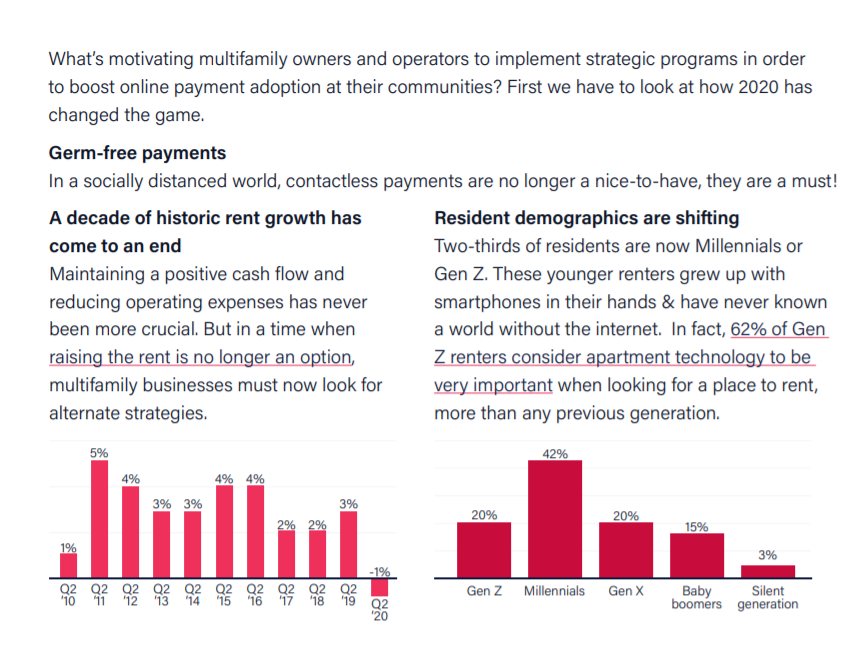

Residents are renting longer, and wanting more

There are more renters now than at any other point in time in the past 50 years. And the National Multifamily Housing Council (NMHC) predicts there will be 4.6 million new rental units by 2030. These numbers make staying competitive in the multifamily housing market increasingly imperative and challenging for apartment building owners and operators.

Alternative and personalized amenities, like credit reporting, have become the “cherry on top” when two competitive apartment communities have similar “sundaes.” In some cases, amenities like rent reporting can be just as effective as the apartment’s location or layout to prospective residents looking for a credit boost.

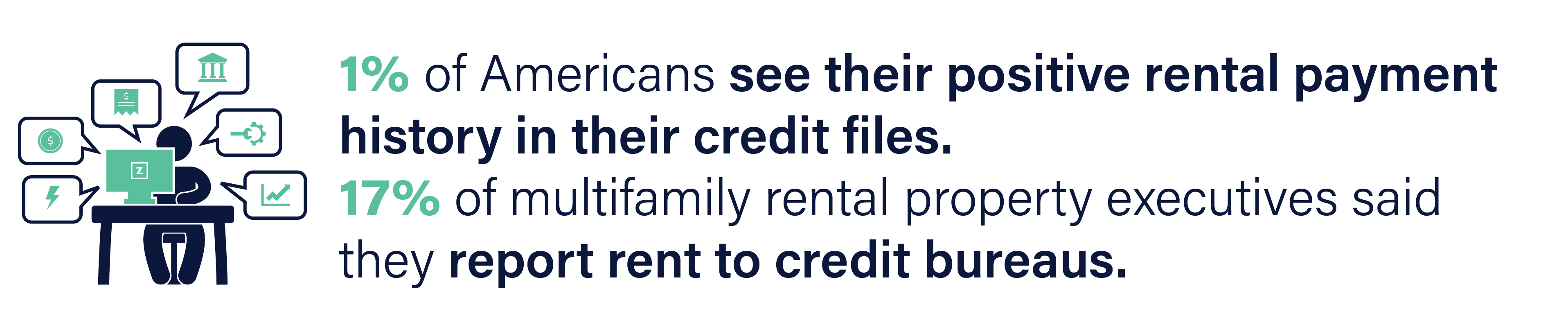

5. How common is rent reporting among multifamily communities?

The demand lacks supply, which creates a huge opportunity for innovative property owners and operators to differentiate their communities. And the best part is, it’s an incentive for the ideal resident. Rental credit reporting attracts people who care about their financial future. They are the renters who you can count on to pay in-full and on-time, because they care about their credit score.

“Residents that pay their rent on time can use this alternative data source to build their credit history towards a more secure financial future” – Maitri Johnson, VP of Multifamily at TransUnion

Greenfield galore!

Mortgage lender, Travis Bourassa, said his company constantly runs credit reports, and he has never seen rent reported on a potential clients’ credit history. Which supports the statistic that less than 1% of residents are reporting their rent payments. By adding an enterprise rent payment reporting solution to your list of amenities, you not only gain a major competitive advantage. But you also have the unique opportunity to educate the market as an innovator.

6. How to offer rent payment reporting to residents

Property management companies can partner with a payment provider that not only lets them offer rental credit reporting to their residents, but also fields support inquiries, assists with marketing efforts, and seamlessly integrates with their software. Perhaps the goliath management firms with proprietary payment technology could theoretically build a credit reporting tool into their own platform. However, it likely wouldn’t have all the bells and whistles included in a best-in-class, third party program.

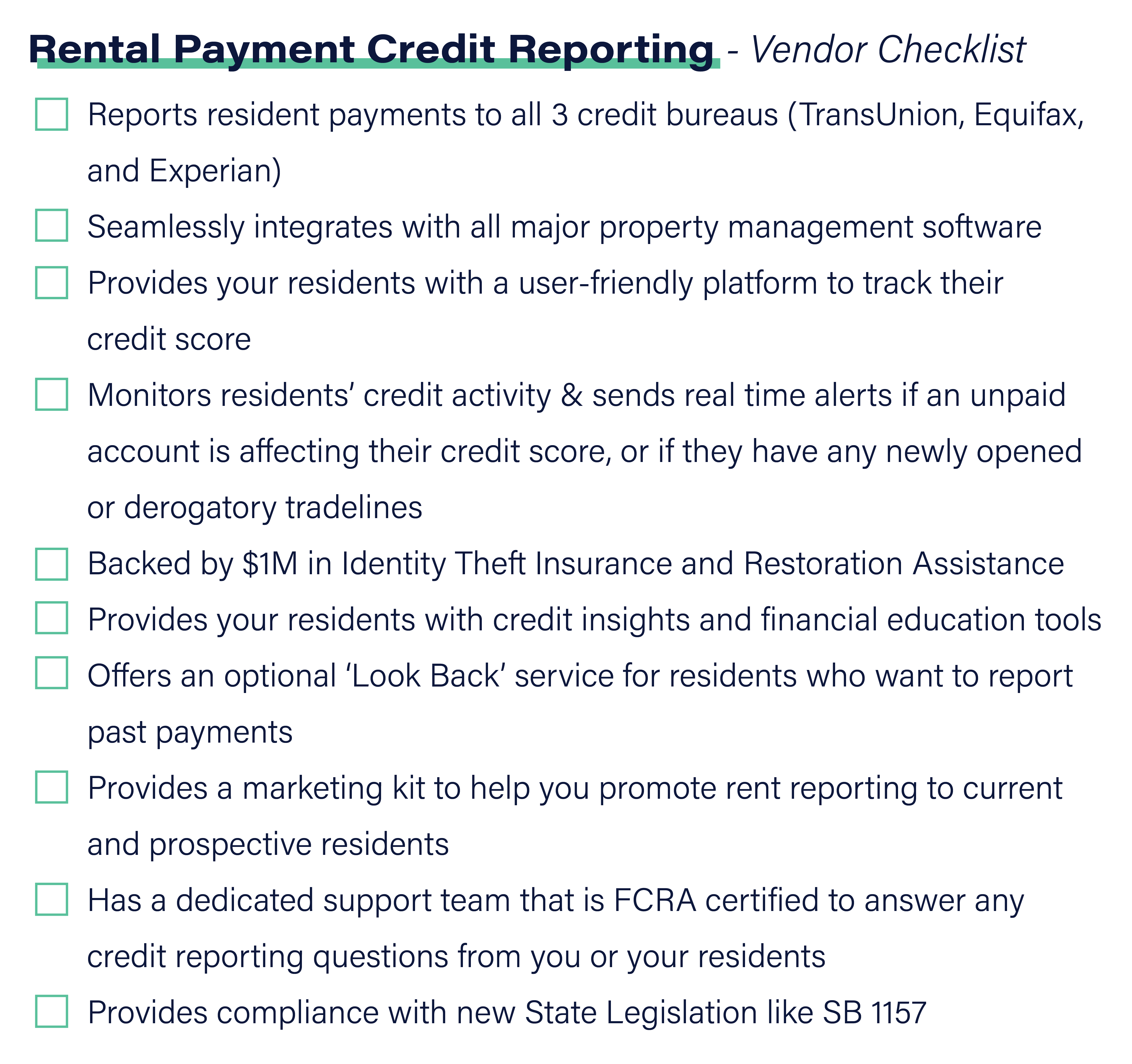

So if you are interested in partnering with a best-in-breed provider like Zego or LevelCredit, we’ve put together this simple vendor checklist to help narrow down what multifamily operators should look for in a rental credit reporting partner.

Get more information how to offer rental payment credit reporting with Zego™ + LevelCredit.

7. What can I do to promote rent reporting to my residents?

Best-in-class payment providers will assist with marketing efforts to help communities get the word out. Top providers will also offer a rent payment reporting adoption playbook during onboarding. Taking advantage of these types of resources is key to not only informing, but also educating your resident base on the value of rent payment reporting.

There are a few factors to consider when deciding on the best marketing efforts for your portfolio:

-

- How many resident email addresses you have in your database.

- Whether you want to control all of the marketing and branding yourself, or let your provider reach out to your residents directly.

- What resources you have, and where your residents are communicating. Do the majority of your residents follow your community page on social media? Or is there a community bulletin board your residents consistently interact with?

Quick & easy marketing initiatives

After considering what resources are available, we suggest a few quick & easy initiatives that typically see some traction. These “quick & easy” initiatives include:

Introductory email & updates to the welcome kit

Lost on verbiage? Check out a few of our introduction to rent payment reporting sample emails. Want to really get your residents attention? The Past Payment Reporting sample email yielded a 41% click through rate with current clients.

Flyers, door hangers, and other printed collateral

Remember that flyers and other printed collateral should be community-branded, and should always include a link to the rent payment reporting registration page, or your community’s website. Place print materials in common spaces (by the front desk, in the hallways, on main community doors, elevators, laundry rooms, etc).

Automated email campaigns

Depending on the number of resident email addresses you’ve collected in your database, best-in-class providers can help you run email campaigns. Pick a cadence (monthly, bi-monthly, bi-annually, etc), and send automatic emails with important information. Your provider should have pre-written email templates on how rent payment reporting works, how residents sign-up, the features and benefits of rent reporting, credit score statistics, insights, and more.

Roll up your sleeves marketing initiatives

If you’ve tackled the “quick & easy” initiatives, and still have bandwidth, it’s time to go the extra mile. These ‘extra mile’ initiatives are geared towards management firms looking for higher digital payment adoption rates, improved cash-flow, less late payments, etc. Here’s how to crank your marketing efforts up a notch:

- Run an organic social media campaign (mostly targeting current residents)

- Run a paid social media campaign (to target prospective residents)

- PPC advertising

- Set up automatic rent reminders that include a rent payment reporting call to action

- Send out a community-wide text message (sms) that includes a tokenized link to opt-in

- Include dynamic messaging about rent payment reporting on residents’ monthly statements

- Include an article about rent payment reporting in your community newsletter or blog

There’s a lot you can do, but don’t get overwhelmed. Follow the timeline below for a successful 6-week rollout.

Marketing rental credit reporting to student housing communities

Typically, student renters are green to the idea of building credit. Which is why standard marketing initiatives don’t always succeed at student housing communities. Students are overwhelmed with classes, extracurriculars, and friends. They’ll easily ignore a door-hanger, or an email from their property manager about building their credit. Especially since most of these young renters won’t have an upcoming home or auto purchase that they need good credit for. So we suggest you tailor your marketing efforts towards the parents and guarantors. They’re more likely to recognize the value of rent payment reporting, and enroll their child in the program. Which will help drive program adoption.

Another successful tactic is to market to the RAs (Resident Assistants). Students look up to their RAs, so why not incentive them to become an ambassador for rent reporting?

If you do decide to directly market to student housing residents, tone down the CTA (call to action). Let the messaging be centered around credit education. Teach students about how credit works, and provide real-world examples of the benefits of a good score. Also, address the common misconception that rent payments are automatically reported to the credit bureaus. But let them know that option is available to them. And provide simple instructions for opting-in.

Sharing explainer videos (like the one below) is a great way to educate residents and spark interest.

Further questions

We hope these FAQs helped shed some light on the confusing world of rental credit reporting. Look out for the next blog in our rent reporting series, The top 4 reasons your residents want to report rent payments to credit bureaus. If you have any further questions, please contact us.

Want to achieve 100% digital payment adoption? Rental credit reporting is a great incentive for online payments, but it’s only the start. Download the The property manager’s guide to 100% online rent payment adoption for 5 proven steps you can take to get more digital payments.